Feb 3, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Just over 10 years ago, in June 2014, the U.S. Supreme Court ruled unanimously, 9-0, that inherited IRAs are NOT protected in bankruptcy under federal law. The primary issue before the Court was whether an inherited IRA is a...

Feb 1, 2025 | Uncategorized

Darren Leavitt, CFA US financial markets were extremely busy last week as a rush to download a Chinese AI platform called Deep Seek from Apple’s App Store seemingly changed the narrative around artificial intelligence in a heartbeat and on multiple fronts. Capital...

Jan 30, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: I have an IRA holding an immediate annuity as well as other IRAs. With the passage of the SECURE 2.0 Act, l understand that I may be able to apply my monthly annuity payments against my RMD requirement for all of my IRAs....

Jan 30, 2025 | Weekly Newsletter

Key Points If you’re nearing retirement, key changes for 2025 could affect your finances, according to advisors. Starting in 2025, there’s a higher 401(k) plan catch-up contribution for workers ages 60 to 63. Plus, there are new rules for inherited individual...

Jan 29, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst You probably know there’s a limit on the amount of pre-tax and Roth contributions you can make to your company savings plan each year. The 2025 elective deferral limit is $23,500 for 401(k), 403(b) and 457(b) plans and is either...

Jan 27, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Many of the provisions of the Tax Cuts and Jobs Act are scheduled to expire at the end of 2025. There are currently a number of proposals in the works in Congress to extend these tax cuts. A serious hurdle is how...

Jan 26, 2025 | Uncategorized

Darren Leavitt, CFA Wow, what a week! US markets were closed on Monday for Martin Luther King Jr. Day, and Donald Trump was inaugurated as the 47th President of the United States. It was a historic day indeed. The global markets were poised for a barrage of executive...

Jan 24, 2025 | Weekly Newsletter

Our checklist for retiring next year includes everything you need to do before the retirement party. Only you can know if you’re ready for a checklist for retiring in 2025. If you’re 60 or getting there, retirement is no longer a hazy concept in the distance....

Jan 23, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: I have a large non-qualified 457 deferred compensation plan and I am required to take distributions. I am looking to minimize taxes. Can I roll over these funds to an IRA? Answer: Unfortunately,...

Jan 22, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst When the “check engine” light comes on in a vehicle, most people are rightfully concerned that something is wrong. When a fire alarm blares through a building, it is wise to take stock of your surroundings. And when a member...

Jan 20, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Today is Inauguration Day. A new administration has arrived. We also have a new Congress. With the arrival of newly elected officials, many will have hopes of legislative change. When it comes to retirement...

Jan 19, 2025 | Uncategorized

-Darren Leavitt, CFA Financial markets advanced this week as a solid start to the fourth-quarter earnings season, and some better-than-feared inflation data gave investors a reason to buy the most recent dip. The financial sector gained 6.1% on the week as bank...

Jan 16, 2025 | Weekly Newsletter

Most Americans may consider the standard retirement age to be 65, but the so-called “full retirement age” for Social Security is already older than that — and it’s about to hit an even higher age in 2025. Social Security’s full retirement age...

Jan 16, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My wife has two after-tax traditional IRAs at two separate institutions. We are hoping to consolidate them, then convert to a Roth in the next 18 months. She is already retired. She also has an inherited IRA (from her...

Jan 15, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst One of the more controversial rules in the 2022 SECURE 2.0 Act is the requirement that plan catch-up contributions by certain highly-paid employees be made on a Roth basis. Last Friday, (January 10, 2025) the IRS issued proposed...

Jan 13, 2025 | IRA Blog

We are two weeks into 2025. Have you been following through on your New Year’s resolutions? As our readers already know, for an IRA owner not to follow through on his or her annual check up of beneficiary forms could have dire consequences. Repeat after me: In 2025, I...

Jan 12, 2025 | Uncategorized

-Darren Leavitt, CFA US equity markets fell in the first full week of 2025 as investors recalibrated their Federal Reserve monetary policy expectations. Stronger labor data, a robust ISM Services print, and a weaker Consumer Sentiment report showing increased...

Jan 9, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: I am planning for a required minimum distribution (RMD) from both my IRA and 403(b) plan for 2026, my first RMD year. I am in the third year of a 10-year period in which I am rolling over 10% of my 403(b) funds each year to my...

Jan 8, 2025 | Weekly Newsletter

These new rules could make it easier for you to save more money for retirement Participating in a 401(k) plan where you work is a smart way to invest for retirement. Plus, your employer may match some or all of the money you contribute. In 2025 the rules for 401(k)s...

Jan 8, 2025 | IRA Blog

When the ball dropped in Times Square on New Year’s Eve, a number of new retirement account provisions became effective. We’ve previously written about each of these new rules in The Slott Report. This article will serve as a checklist, with links to the prior...

Jan 6, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The year 2025 is upon us! There is no doubt that this will be an eventful time for retirement accounts. As the new year kicks off, here is what we are talking about now at the Slott Report. 1. Increased...

Jan 5, 2025 | Uncategorized

-Darren Leavitt, CFA The final trading sessions for 2024 extended losses from the prior week, but the S&P 500 and NASDAQ still posted impressive gains for the year, 23.3% and 28.6%, respectively. The so-called Santa Clause Rally did not appear for the second...

Jan 3, 2025 | Weekly Newsletter

How Secure 2.0 and inflation adjustments will affect retirement savers and spenders. For retirement savers, the ringing in of the new year will bring more than the usual inflation adjustments to retirement contributions. The retirement legislation known as Secure 2.0...

Jan 2, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: Hello, Our daughter (age 50) is the sole beneficiary of her husband’s (age 52) IRA due to his death in April 2024. Is there a time limit for when she must either take ownership or roll it...

Dec 30, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst I counted them. This year the Slott Report published 101 blog articles. While other sites add “pay-for-content” firewalls, we continue to pump out incredibly valuable and important information, week after week, totally free...

Dec 28, 2024 | Uncategorized

-Darren Leavitt, CFA Market action was mixed in a holiday-shortened week of trade. The Santa Clause rally, which runs for the last five trading sessions of the year through the first two trading sessions of the New Year, kicked off with gains from mega-cap...

Dec 27, 2024 | Weekly Newsletter

Key Takeaways A recent Gallup poll showed most Americans feel they are worse off today than four years ago. Data on household finances show that things have changed dramatically since September 2020, when the COVID-19 pandemic was affecting the economy. Americans have...

Dec 23, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst This is the time of year for good cheer and holiday wishes. In keeping with those traditions, here are some cheers and wishes for the IRS and Congress: Cheers to the IRS: Yes, it did take the IRS 4½ years to issue final required...

Dec 22, 2024 | Uncategorized

-Darren Leavitt, CFA Equity and fixed-income markets sold off for the second consecutive week as the Federal Reserve delivered an expected twenty-five basis-point rate cut but pivoted to a much more hawkish stance for 2025, where the committee now expects only two...

Dec 19, 2024 | Weekly Newsletter

Key Takeaways An Employee Benefit Research Institute survey found that more than two-thirds of retirees had outstanding credit card debt in 2024, up from 40% in 2022. Even though inflation has cooled, high prices weigh on retirees. Almost a third of retirees said they...

Dec 19, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: If a client opens an IRA at age 75 and makes a contribution this year, this account would not have a required minimum distribution (RMD) for 2024, correct? Since the IRA did not exist last year, there is no...

Dec 18, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The IRA rollover rules are always tricky. However, if you are rolling over an IRA distribution when the calendar year changes, the rules can become especially challenging. Here are four things you need to...

Dec 16, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Tis the season for giving, and qualified charitable distributions (QCDs) are a popular way to donate to a favorite charity. However, rules must be followed. In a recent Slott Report entry (“QCD Timing,” December 4), I...

Dec 15, 2024 | Uncategorized

-Darren Leavitt, CFA The Nasdaq eclipsed the 20,000 level for the first time this week as investors reengaged in buying the mega-cap technology names. Amazon, Google, Tesla, and Meta hit new highs for the year as investors heard about more advances in AI and quantum...

Dec 12, 2024 | Weekly Newsletter

Key Takeaways Some provisions related to the Secure 2.0, a federal retirement law, will go into effect in 2025. Workers ages 60, 61, 62, or 63 will be able to make catch-up contributions of up to $11,250 in 2025. Workplace retirement plans such as 401(k) and 403(b)...

Dec 12, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: Can a person do a rollover from both his traditional AND Roth IRAs in the same twelve months? Best regards, Matthew Answer: Hi Matthew, The once-per-year rollover rule restricts an individual from...

Dec 9, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The holidays are upon us. There is shopping to do, gifts to wrap, and parties to attend. Amidst the hustle and bustle of the season, you may be forgiven if your retirement account is not at the top of your...

Dec 8, 2024 | Uncategorized

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate cuts. Leadership in the market toggled back to the mega-cap technology issues, with the communication...

Dec 5, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Question: If you continue to work past age 73, are you exempt from required minimum distributions (RMDs)? My 73 year-old wife is still working and contributing to her company’s 401(k), and she doesn’t own more than 5% of the...

Dec 4, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Year after year, this topic continues to bubble up. Confusion exists over when a QCD can be done in relation to the RMD. Qualified charitable distributions (QCDs) can offset all or a portion of an RMD (required minimum...

Dec 2, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Get ready! Several new 401(k) provisions from the SECURE 2.0 Act kick in on January 1, 2025. One that we’ve already written about is the ability of employees to make extra catch-up contributions in a year they turn age 60, 61, 62...

Dec 2, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Get ready! Several new 401(k) provisions from the SECURE 2.0 Act kick in on January 1, 2025. One that we’ve already written about is the ability of employees to make extra catch-up contributions in a year they turn age 60, 61, 62...

Dec 1, 2024 | Uncategorized

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 and Dow rise to new all-time highs. Investors cheered the nomination of Scott Bessent as Treasury Secretary, who is seen as a fiscal hawk and someone who will support Trump’s trade policies. US...

Nov 28, 2024 | Weekly Newsletter

Navigate these tax and retirement milestones to optimize savings and avoid penalties. Staying on top of year-end tasks helps you avoid penalties and take full advantage of tax benefits. Key Takeaways Contributions to retirement accounts like 401(k)s must be made by...

Nov 27, 2024 | IRA Blog

Sarah Brenner, JD Director of Retirement Education Each year it is a Thanksgiving tradition here at the Slott Report to take a moment to give thanks for the rules that are helpful to retirement savers. There are many times when rules governing retirement accounts can...

Nov 25, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst When an IRA owner dies, what is the payout schedule for the beneficiary? The key to distinguishing the correct program (i.e., 10-year rule, stretch RMDs, 5-year rule, etc.) is to identify all the important variables. But...

Nov 24, 2024 | Uncategorized

-Darren Leavitt, CFA Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late Friday announced Scott Bessent as his nominee for Treasury Secretary. Wall Street has endorsed Bessent,...

Nov 21, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello Ed Slott Team, We have a client with an IRA who wants to do a qualified charitable distribution (QCD) to a charity. The charity also has an account with the same custodian of the IRA and has asked that the...

Nov 21, 2024 | Weekly Newsletter

The Social Security Administration has announced the 2025 final COLA, wage cap, and amount needed to earn SS credits. Anticipating changes coming to Social Security in 2025 can help you start planning for the new year and identify any adjustments you can make to...

Nov 20, 2024 | IRA Blog

Ian Berger, JD IRA Analyst Here’s something you can only find in the Internal Revenue Code: Starting in 2025, there will be not one, not two, but three different catch-up limits for older SIMPLE IRA participants. Like IRAs and workplace plans like 401(k)s, SIMPLE IRAs...

Nov 18, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Health Savings Accounts (HSAs) continue to become more popular. If you have a qualifying high deductible health plan, you may make deductible contributions to an HSA. Then, you can take tax-free...

Nov 17, 2024 | Uncategorized

-Darren Leavitt, CFA US equity markets pulled back last week as investors took profits from the outsized move higher seen following the US election. Sticky inflation prints, coupled with solid retail sales and hawkish comments from Federal Reserve Chairman J. Powell,...

Nov 13, 2024 | Weekly Newsletter

Downsizing for retirement is a good way to simplify your life and cut down on expenses. Making some key changes, like moving into a smaller home, could reduce financial strain and improve your quality of life. It could also give you room to grow in new, unexpected...

Nov 13, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Roth IRA conversions remain as popular as ever. However, based on some recent questions we’ve received, it is apparent that folks don’t fully understand all the nuances of this transaction. Here are some of the basic...

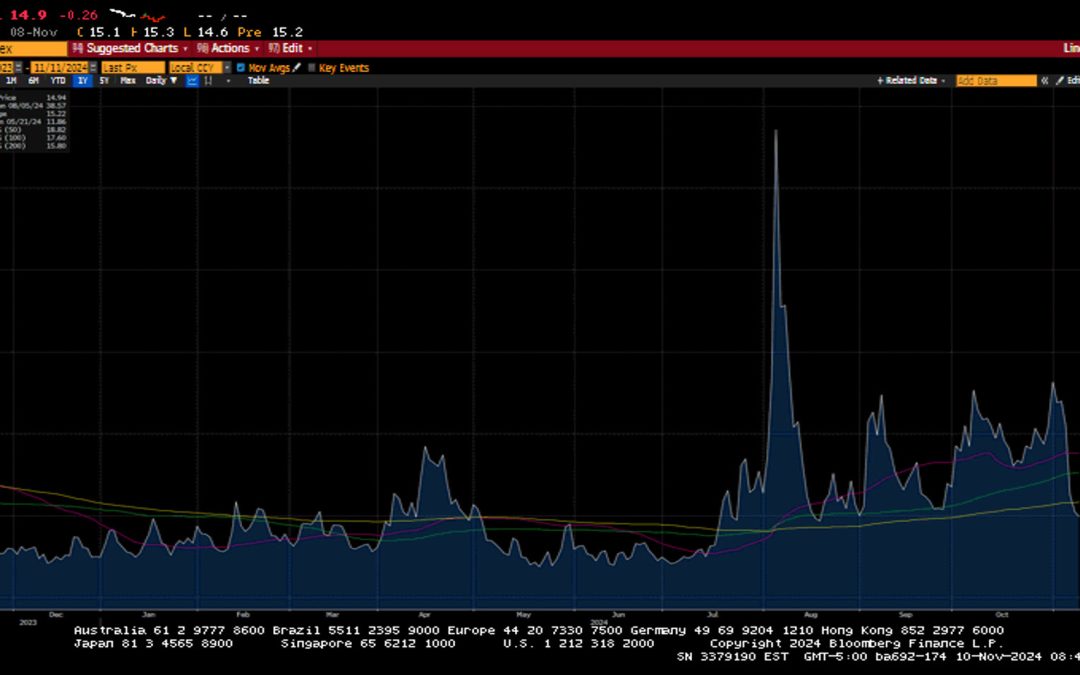

Nov 10, 2024 | Uncategorized

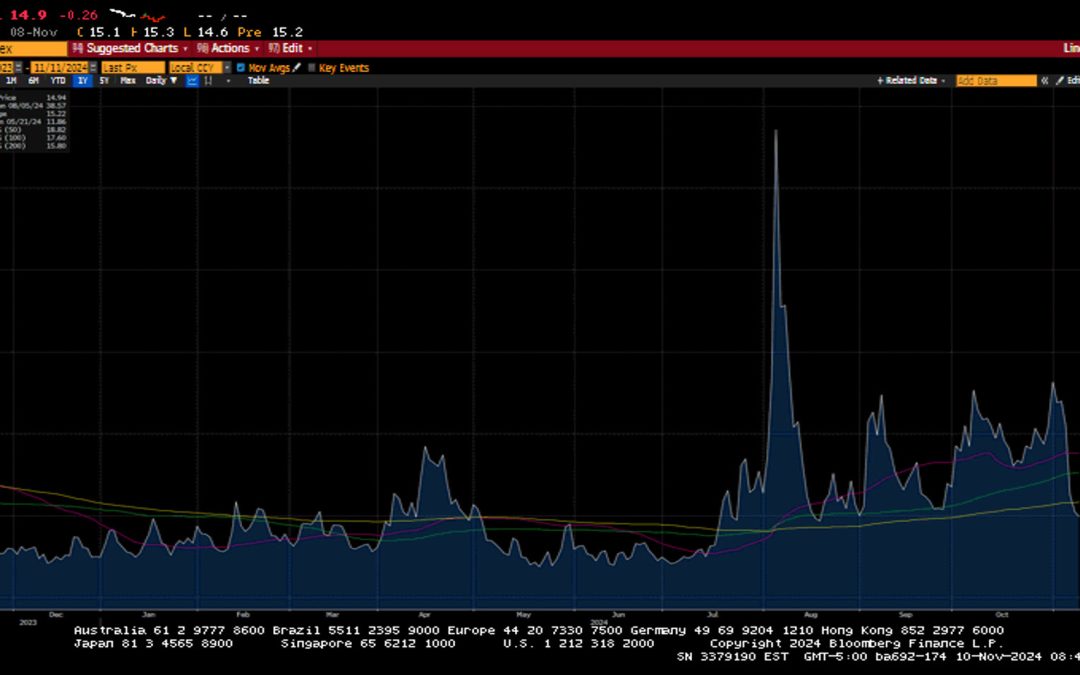

-Darren Leavitt, CFA The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the idea that President-Elect Trump would enact several pro-growth policies to bolster corporate profits. ...

Nov 8, 2024 | Weekly Newsletter

Retirement: the wonderful time of life when you no longer have to work for your money. Instead, your money is finally working for you. If you’re well on your way to retirement, kudos to you. Today, more Americans are retiring than ever before. According to...

Nov 4, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Yes, you read that title correctly. This rule was confirmed in the 2024 final SECURE Act regulations, released this past July. If a person has multiple IRAs, even if they are held at different custodians, the total...

Nov 3, 2024 | Uncategorized

-Darren Leavitt, CFA It was a very busy week on Wall Street as investors analyzed a deluge of corporate earnings reports and a full economic data calendar. The S&P 500 traded lower for the second consecutive week and could not close out October with a gain,...

Oct 31, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I’m working with a retired client who has a sizable IRA. He set up a trust and named it as the beneficiary of the IRA, assuming that the trust would reduce or eliminate the income tax liability. Is this the...

Oct 31, 2024 | Weekly Newsletter

Key Points Many Americans face a retirement savings shortfall, but setting aside more could get easier for some older workers in 2025. Enacted in 2022, the Secure Act 2.0 ushered in several retirement system improvements, including higher 401(k) plan catch-up...

Oct 30, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Don’t forget to turn your clocks back this weekend! With that reminder comes another: pay attention to the Roth IRA distribution clocks. The key point to remember is that there are two different clocks, each used for a different purpose....

Oct 28, 2024 | Uncategorized

-Darren Leavitt, CFA Global markets pulled back last week as investors took the opportunity to reduce some risk before a very close US Presidential election. In the US, nearly 20% of the S&P 500 reported earnings. Generally, results came in better than expected;...

Oct 28, 2024 | IRA Blog

Sarah Brenner, JD Director of Retirement Education The year 2024 has flown by and the holidays season will soon be upon us. That means time is running out on year-end IRA deadlines. You will want to be sure to get the following three IRA-related tasks done...

Oct 23, 2024 | Weekly Newsletter

The Federal Reserve just reduced interest rates for the first time in four years. Here’s how it will impact borrowers and saver What goes up must come down, and after four years, that’s finally true about interest rates. The Federal Reserve cut its benchmark rate on...

Oct 23, 2024 | Uncategorized

The Federal Reserve just reduced interest rates for the first time in four years. Here’s how it will impact borrowers and saver What goes up must come down, and after four years, that’s finally true about interest rates. The Federal Reserve cut its benchmark rate on...

Oct 23, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst This article is NOT about the “ghost rule” applicable to non-living beneficiaries. That payout rule applies when a non-person beneficiary (like an estate) inherits an IRA when the original owner died on or after his required...

Oct 21, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst The year is flying by, and before we know it 2025 will be here. With the arrival of the new year, several new provisions from the 2022 SECURE 2.0 law that impact retirement plans will become effective. One of the changes allows certain...

Oct 20, 2024 | Uncategorized

-Darren Leavitt, CFA The S&P 500 advanced for the sixth consecutive week, closing at a new record high. This week, a broadening out of the market’s rally was evident, with small caps and the equally weighted S&P 500 index outperforming. Markets also appear to...

Oct 17, 2024 | IRA Blog

Ian Berger, JD IRA Analyst Question: We have a client who has children from a previous marriage. Upon the husband’s death, he wants to make sure his current spouse has access to income from his IRA. But he also wants to make sure the remaining balance, when she...

Oct 17, 2024 | Weekly Newsletter

With inflation cooling, analysts estimate benefit boost could come in around 2.5% The second of three numbers the Social Security Administration (SSA) will use to determine the 2025 cost-of-living adjustment (COLA) is in, and it points to a more modest increase in...

Oct 16, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education October 15, 2024 has come and gone. This was the deadline for correcting 2023 excess IRA contributions without penalty. If you missed this opportunity, you may be wondering what your next steps should be....

Oct 14, 2024 | IRA Blog

We have written about the net unrealized appreciation (NUA) tax strategy many times. Generally, after a lump sum distribution from the plan, the NUA tactic enables an eligible person to pay long term capital gains (LTCG) tax on the growth of company stock that...

Oct 13, 2024 | Uncategorized

-Darren Leavitt, CFA The S&P 500 and Dow Jones Industrial Average forged another set of all-time highs despite facing several macro headwinds. Chinese markets reopened after celebrating Golden Week with significant losses. Investors were expecting an announcement...

Oct 12, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Good afternoon, If a client passed this year with four adult children inheriting equally, and each beneficiary is using the 10-year rule, how do they determine yearly required minimum distribution (RMD)...

Oct 9, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Victims of Hurricane Helene have at least a glimmer of good news when it comes to their tax filings and ability to withdraw from their retirement accounts for disaster-related expenses. The IRS usually postpones certain tax deadlines for...

Oct 9, 2024 | Weekly Newsletter

Everyone aspires to have a steady source of income after retirement that replaces as much as possible of their pre-retirement earning. But for many people, one big challenge in saving for that goal is to find the right financial product that accommodates their...

Oct 7, 2024 | IRA Blog

Sarah Brenner, JD Director of Retirement Education The recent final required minimum distribution (RMD) regulations include a new rule change that may be beneficial for IRA owners who name trusts as beneficiaries. In the new regulations, the IRS allows separate...

Oct 6, 2024 | Uncategorized

-Darren Leavitt, CFA The S&P 500 closed higher for a fourth consecutive quarter, the first time it has done so since 2011. Investors continued to face a challenging macro environment. Escalating tensions in the Middle East, a Longshoremen’s strike, the aftermath...

Oct 3, 2024 | Weekly Newsletter

Summary – However, almost 8 in 10 workers and 7 in 10 retirees are concerned that the U. S. government could make significant changes to the American retirement system – A new report published today from the 34th annual Retirement Confidence Survey finds...

Oct 2, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst When a traditional IRA owner wants to convert all or a portion of his account to a Roth IRA, he needs to think long and hard about the transaction. For example, some questions to consider: 1. When will this money be needed?...

Sep 30, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst A big change made by the SECURE 2.0 Act of 2022 was adding a new statute of limitations (SOL) for the IRS to assess penalties for missed required minimum distributions (RMDs) and excess IRA contributions. On its face, it looks like...

Sep 29, 2024 | Uncategorized

-Darren Leavitt, CFA US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several...

Sep 29, 2024 | Uncategorized

-Darren Leavitt, CFA US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several...

Sep 29, 2024 | Uncategorized

-Darren Leavitt, CFA US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several...

Sep 27, 2024 | Weekly Newsletter

Critically underprepared for retirement, 55-year-old Americans enter a crucial 10-year countdown to plan and prepare With just a decade until retirement, 55-year-old Americans have less than $50K in median retirement savings First modern generation confronting...

Sep 26, 2024 | IRA Blog

Sarah Brenner, JD Director of Retirement Education Question: When an IRA owner dies after their required beginning date, can an eligible designated beneficiary choose either the life expectancy option or the 10-year payout rule? Answer: If an IRA owner dies on or...

Sep 25, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education It happens. You have made a 2023 contribution to the wrong type of IRA. All is not lost. That contribution can be recharacterized. While recharacterization of Roth IRA conversions was eliminated by the Tax...

Sep 23, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst When presenting a particular section of our training manual, I usually make the joke that, “if we were playing an acronym drinking game, we would all be on our way to a hangover.” The segment is titled: “Missed stretch IRA...

Sep 22, 2024 | Uncategorized

The S&P 500 notched its 39th record high in 2024 on the back of a fifty-basis-point rate cut by the Federal Reserve. Global central banks took center stage this week, with the Fed playing the headliner. Leading into the Fed’s decision, the street was divided over...

Sep 19, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst Question: I inherited an IRA from a younger deceased spouse who wasn’t required to take required minimum distributions (RMDs) until this year. Can I take advantage of the new section 327 rules under SECURE 2.0 since the RMDs haven’t...

Sep 19, 2024 | Weekly Newsletter

Federal Reserve data shows sharp rise in amount Americans 65 and older owe Americans across generations are carrying more debt than they did three decades ago, according to Federal Reserve data, but the rise has been especially steep among the oldest age groups. The...

Sep 18, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst If you were born in 1959, what is the first year that you must start taking required minimum distributions (RMDs)? That would seem like an easy question to answer, but because of a snafu by Congress, it isn’t quite so clear. For many...

Sep 16, 2024 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education If you take a distribution from your traditional IRA, in most cases you will owe taxes. The government wants to be sure those taxes are paid, so IRA distributions are subject to federal income tax withholding. The...

Sep 15, 2024 | Uncategorized

-Darren Leavitt, CFA Markets bounced back nicely in the second week of September. It was an intriguing week of trade with several undercurrents to consider. The first and likely only Presidential debate between Harris and Trump appeared to be won by Harris, although...

Sep 12, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: I inherited a traditional IRA from my mother in 2024. She passed before her required beginning date (RBD.) I know that I fall under the 10-year rule. The question is, do I need to start required minimum distributions...

Sep 12, 2024 | Weekly Newsletter

Saving and investing early, often, and continuously throughout your entire working career is absolutely critical to securing your financial future in retirement. Making contributions to your 401(k) or IRA provides tax benefits, allowing you to defer taxes owed on your...

Sep 11, 2024 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Workplace retirement plans – like a 401(k) – can hold different types of dollars. Typically, a 401(k) will have a pre-tax bucket and a Roth bucket. Occasionally, a plan will have a third bucket to hold after-tax (non-Roth) money....

Sep 9, 2024 | IRA Blog

By Ian Berger, JD IRA Analyst If you are making student loan repayments, you should ask your employer if it will match those payments in the company’s retirement plan. The SECURE 2.0 Act allows for matching contributions on “qualified student loan payments” (or...

Sep 5, 2024 | IRA Blog

Sarah Brenner, JD Director of Retirement Education Question: Can I roll over a Roth 401(k) to an existing Roth IRA or does it need to be in its own separate account? When does the 5-year holding period begin for the Roth 401K rollover? Thank you, Elisabeth Answer: Hi...