Jul 2, 2025 | Weekly Newsletter

A wonderful retirement is the goal of many people, and you want it to come off without any major snags. But retirement plans always face challenges, whether it’s the volatility of the markets, the affordability of healthcare or the risks posed by inflation. Plus,...

Jul 2, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education When retirement account funds are on the move, things do not always go as planned. The best way to move these funds is to do so directly, but that may not always be possible. It is very common for money to be moved...

Jun 30, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst The pro-rata rule dictates that when an IRA contains both non-deductible (after-tax) and deductible (pre-tax) funds, then each dollar withdrawn (or converted) from the IRA will contain a percentage of tax-free and taxable funds...

Jun 29, 2025 | Uncategorized

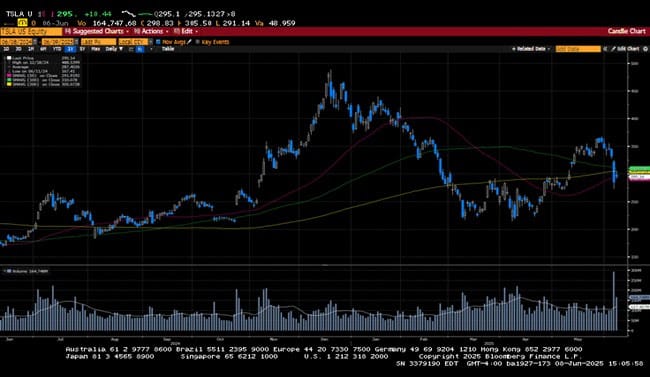

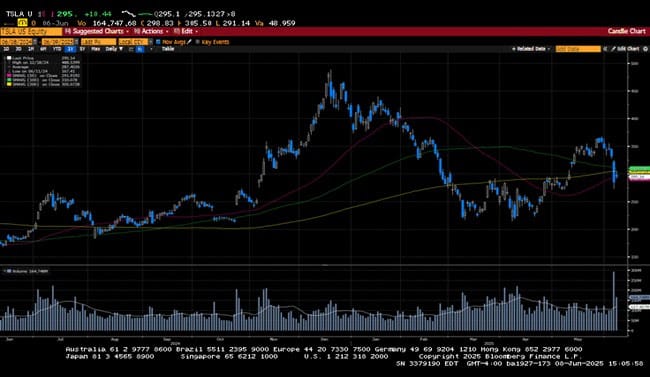

The S&P 500 and the NASDAQ joined the NASDAQ 100 in forging new all-time highs in an extremely busy week for Wall Street. A de-escalation of the Iran-Israel-US conflict happened on the twelfth day after Israel’s initial strikes. The US bombed three key...

Jun 26, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: I am over age 59½ and have had a Roth IRA account for more than 5 years. Starting in 2025, I designated all of my contributions into my employer’s 401(k) plan as Roth contributions. If I decide to retire before I have met the...

Jun 26, 2025 | Weekly Newsletter

Retirement planning is rarely perfect. Life throws curveballs—health issues, market downturns, career changes—and even the most diligent savers can stumble along the way. If you’ve made financial missteps or feel unprepared as you approach retirement, you’re not...

Jun 25, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst If you’re in a 457(b) plan and are nearing retirement, you may want to consider an often-overlooked rule that could allow you to defer twice the usual annual elective deferral limit (for 2025, $23,000 x 2 = $47,000) in the three...

Jun 23, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The year 2025 has been a turbulent time for the economy. Whether due to job loss or persons seeking better investment opportunities in volatile markets, retirement account funds are on the move more than...

Jun 22, 2025 | Uncategorized

Despite there being plenty for investors to consider, the holiday-shortened week ended pretty much where it started. Israel and Iran continued to exchange missile attacks, while global leaders tried to find a resolution to the conflict. President Trump opened the door...

Jun 20, 2025 | Weekly Newsletter

Budgeting, saving and investing tips to help make your money last as long as you do No matter how diligently you’ve been saving for retirement, it’s hard not to worry about outliving your money. But you can take several steps to contain your expenses, manage your nest...

Jun 19, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: I am age 85, and my wife is age 75. If I die first and my wife inherits my IRA, are the required minimum distributions (RMDs) that my wife must take after my death calculated using her age or my age?...

Jun 18, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Before he transformed into the Incredible Hulk, Bruce Banner once said to his antagonist, “Don’t make me angry. You wouldn’t like me when I’m angry.” That’s a little how I feel when I hear stories about lazy financial professionals...

Jun 16, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst You are not alone if you have concerns that your IRA or workplace plan savings could be lost if you are forced to declare bankruptcy or wind up on the losing end of a civil lawsuit. After all, we all count on those savings for a...

Jun 12, 2025 | Weekly Newsletter

Take these steps when you receive a windfall Perhaps you are among the growing number of Americans fortunate enough to receive an inheritance. As older generations pass away and leave money to their families, a great wealth transfer is underway. Those bequests could...

Jun 12, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I have two IRA annuities with different insurance companies. One of my annuities is maturing and I would like to transfer it upon maturity to a different insurance company. Do I need to take my 2025 required...

Jun 11, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Here at the Slott Report we hear many stories about trusts being named as IRA beneficiaries and the problems that follow. Often, there seems to be no purpose for naming the trust and it brings unnecessary...

Jun 9, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst We know that required minimum distributions (RMDs) cannot be rolled over or converted. Before a person does any Roth IRA conversions, all of their IRA RMDs must be satisfied. (See this prior Slott Report post: “New Rule: All IRA...

Jun 8, 2025 | Uncategorized

US markets advanced in an erratic week of trading. The S&P 500 ended the week above the 6000 level and is up nearly 24% from the April 7th lows. Investors continue monitoring global trade policy, hoping more trade deals will be signed soon. Trump acknowledged...

Jun 6, 2025 | Weekly Newsletter

A quiet but important shift is happening in 2025: the full retirement age for Social Security is increasing again. If you were born in 1959, the change affects you directly—and if you were born in 1960 or later, you’re next. Here’s what this change means for your...

Jun 5, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: Recently, I’ve received dozens of emails suggesting that traditional IRA owners can convert to a Roth IRA and somehow avoid all or some tax. Is this a scam? Thank you in advance. Bill Answer: Hi Bill, There is no way for...

Jun 2, 2025 | Uncategorized

-Darren Leavitt, CFA The holiday-shortened week was busy. Trade uncertainties continued to be on investors’ minds, with several trade stories hitting the tape throughout the week. News on Tuesday that President Trump had extended the timeline for negotiations...

May 29, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: Hello, I have a question concerning inherited Roth IRAs. I know that in the past you have said that no annual required minimum distributions (RMDs) are required for these accounts. Does this...

May 28, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Regardless of the topic, we could all use an occasional refresher. Retirement account rules are incredibly complicated, and we all have our blind spots. Even seasoned financial advisors with extensive client lists can overlook...

May 22, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Thank you for all you do to educate the public. I’m hoping you guys can settle a debate that’s been going on with a few financial advisors and CPAs regarding the 5-year rule for Roth IRA conversions. I was...

May 22, 2025 | Weekly Newsletter

Say goodbye to second cars, warehouse stores and other no-longer-necessary expenses Retirement is a time to rethink some things: how we fill our hours and days, what we do for fun and fulfillment. And, maybe, all that stuff we’ve been spending money on for years. You...

May 21, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Health Savings Accounts (HSAs) may be one of the biggest tax breaks currently available. If you have a qualifying high-deductible health plan, you may make a deductible contribution to an HSA. There are no income...

May 19, 2025 | IRA Blog

By Andy Ives, CFP®, AIF®| IRA Analyst There are two ways to move money from one IRA to another: a direct transfer or a 60-day rollover. With direct transfers, the funds are sent directly from one custodian to another. The IRA owner has no ability to use the dollars...

May 18, 2025 | Uncategorized

-Darren Leavitt, CFA It was a busy week on Wall Street. The Dow Jones Industrial Index and the S&P 500 went positive for the year, catalyzed by the announcement that China and the US would significantly lower tariffs for 90 days as trade negotiations continue. ...

May 15, 2025 | Weekly Newsletter

You won’t believe how much you can accomplish — and save — in just a few minutes Have 60 minutes to kill? You could spend it watching TV or playing games on your smartphone. Or you could spend it saving money, by ticking some easy but important financial tasks...

May 15, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: Our client is 75 years old. He just retired on January 1, 2025. The company has recognized his retirement date as being January 1, 2025. When must he take his first required minimum distribution (RMD)? Rick Answer: Hi...

May 14, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Many retirement plans base employer contributions on employee compensation. For many years, Congress has limited the compensation that can be taken into account for those contributions. Fortunately, this dollar limit only applies...

May 12, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The IRS has introduced a new code for the reporting of qualified charitable distributions (QCDs) by IRA custodians on Form 1099-R. How QCDs Work QCDs first became available in 2006, and they were made permanent in...

May 11, 2025 | Uncategorized

-Darren Leavitt, CFA US financial markets were little changed last week as investors continued to weigh the implications of the Trump administration’s trade policies. A trade agreement between the US and the UK set a constructive tone and is likely to provide a...

May 9, 2025 | Weekly Newsletter

‘Will your money last?’ isn’t the only question to consider before retiring. I was chatting with a friend the other day about his retirement—possibly an early one. At age 60, he has worked hard, saved aggressively, and invested well. Most important, he’s pretty burned...

May 8, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: Since I retired in 2020, each year I have been converting amounts from my employer plan to my Roth IRA. I will be age 73 in 2026. Can I take my required minimum distribution (RMD) amount and convert that...

May 7, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Roth IRAs follow strict distribution ordering rules. Contributions come out first, then converted dollars, and then earnings. It does not matter how many Roth IRAs a person has, or if the accounts are held at multiple custodians....

May 5, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst The April 23, 2025, Slott Report article, “After-Tax 401(k) Contributions Shouldn’t Be an Afterthought,” discusses how 401(k) after-tax contributions can be moved into Roth accounts through in-plan Roth conversions, the “mega...

May 4, 2025 | Uncategorized

-Darren Leavitt, CFA Global markets rallied for a second week as the S&P 500 clinched nine consecutive days of gains- something not seen in two decades. News that trade negotiations between the US and seventeen countries would occur over the next few weeks...

May 1, 2025 | Weekly Newsletter

Surveys show ex-service members retire with more assets, less debt and greater confidence. Here are six ways to follow their lead. When her son Corbett joined the Marine Corps right out of high school in 2013, Lara Ferguson was surprised to learn that he was required...

May 1, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My wife and I created a Roth IRA when our two children were young to pay for their college education. Our daughter is finishing her second year of school, and our son will be entering college this fall. We have withdrawn...

Apr 30, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education While most distributions from a traditional IRA are taxable, sometimes distributions can include after-tax dollars. These after-tax dollars are known as “basis.” Handling and tracking basis in your...

Apr 28, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst When a person under the age of 59½ needs access to his IRA dollars, there is a 10% early withdrawal penalty applied to any distribution, unless an exception applies. One of the many 10% penalty exceptions is a 72(t) “series of...

Apr 27, 2025 | Uncategorized

-Darren Leavitt, CFA Global financial markets rallied on several reports that suggested significant progress was being made on trade negotiations. Vice President Vance met with Indian Prime Minister Modi on his visit to India. The two leaders announced they were in...

Apr 24, 2025 | Weekly Newsletter

Retirement is a time to enjoy your golden years and live life to the fullest. But in order to do that, it’s important to start planning early. Retirement savings can be a complex topic, but there are a few key things to keep in mind to get started. 1. Start...

Apr 24, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: At age 71, I’m not yet subject to required minimum distributions (RMDs) from my IRA or workplace retirement accounts. However, I am required to take annual RMDs from a pre-2020 inherited IRA and a pre-2020 inherited Roth IRA....

Apr 23, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education With the popularity of Roth 401(k) contributions, after-tax (non-Roth) employee contributions have gotten short shrift. But, if your plan offers them, after-tax contributions are worth considering. They can...

Apr 21, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The April 15 tax-filing deadline has come and gone. However, for some 2024 retirement account planning strategies, it’s not too late! There is still time beyond the April 15 deadline. Here are three...

Apr 20, 2025 | Uncategorized

-Darren Leavitt, CFA Equity markets regressed during the abbreviated trading week, while US Treasuries found some footing. Trade policies continued to influence markets and foster uncertainty. Little progress was made on country-specific tariffs, while several...

Apr 18, 2025 | Weekly Newsletter

Baby boomers were never “average.” The generation wears uniqueness is a badge of honor. However, approximately 10,000 boomers turn 65 everyday. While we each have specific goals, ideas and financial circumstances, there are some things that apply to us all. Here is...

Apr 17, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Question: Are rollovers done by a spouse beneficiary subject to the once-per-year IRA rollover rule? The IRA funds were never distributed to me. They were directly transferred from my deceased husband’s IRA to my own IRA....

Apr 16, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst The recent market ride has been nuts. It is certainly no fun for anyone who owns stock or stock funds. Many of us are experiencing the same sensation in our gut as when a roller coaster click, click, clicks to its apex and...

Apr 14, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst In the 2022 SECURE 2.0 legislation, Congress gave the IRS two years – until December 29, 2024 – to come up with rules allowing IRA owners to fix certain mistakes through self-correction. Alas, December 29, 2024 has now come and...

Apr 10, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: A 401(k) plan participant over age 73 wants to roll over his account to a new IRA. I understand that he must take a required minimum distribution (RMD) before the rollover. Is an additional RMD required in the same...

Apr 10, 2025 | Weekly Newsletter

2025 may seem like a bad year to retire if you’re looking at the stock market alone. But that’s not the only consideration. It sure seems like a bad year to retire. The stock markets are falling, taking 401(k) balances along with it, tariffs are in place,...

Apr 9, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Recent turmoil in the markets has hit many retirement savers hard as they see their IRA and 401(k) balances rapidly shrinking. For many, the age-old advice to stay the course for the long term and not cash...

Apr 7, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst As a follow up to the March 26 Slott Report entry that included a full list of the 10% early withdrawal penalty exceptions (“10% Penalty Exceptions: IRAs and Plans”), here we get a little deeper into the weeds on some of the...

Apr 6, 2025 | Uncategorized

-Darren Leavitt, CFA Global financial markets tumbled last week as investors moved out of risk assets, fearing that a worldwide trade war would ensue after Trump’s tariffs were higher than anticipated. Thursday and Friday’s market action resulted in a $5.4...

Apr 3, 2025 | IRA Blog

Question: My wife turns 73 years old in August 2025. My understanding is that she has until April 1, 2026, to take her first required minimum distribution (RMD), in which case she would wind up taking two RMDs in 2026. The RMD for 2025 is approximately $24,000. My...

Apr 2, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst When you file for bankruptcy, one thing you usually don’t have to worry about is protecting your IRA funds from your bankruptcy creditors. That’s because, in just about every case, all of your IRA (and Roth IRA) monies are off limits....

Mar 31, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education There is still time! You can still make a prior-year (2024) IRA or Roth IRA contribution up to the tax filing due date, April 15, 2025. For most people, there is no extension beyond that date, regardless of...

Mar 30, 2025 | Uncategorized

-Darren Leavitt, CFA It’s been a difficult month for investors, and sentiment indicators tell that story. Wall Street appeared poised to build on the prior week’s gains, but regressed again as mixed signals on tariffs and a loss of sentiment gave reason...

Mar 27, 2025 | Weekly Newsletter

It’s not just inflation. Your bad habits may explain why you’re paying too much for groceries. Retirees living on fixed incomes have been feeling the pinch of rising grocery costs. Grocery prices in February rose 2.6 percent year-over-year, according to the U.S....

Mar 27, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Question: In the article “Why You Should Take Your 2025 RMD Now,” the following caught my eye … “Or, maybe you are charitably inclined and looking to satisfy your RMD by doing a qualified charitable distribution (QCD). This will...

Mar 26, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst If a person under age 59½ takes a withdrawal from his IRA or workplace plan, there is a 10% early withdrawal penalty…unless an exception applies. There are currently 20 exceptions, with a 21st on the way. Here are those exceptions,...

Mar 24, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst We continue to get lots of questions about the new “super catch-up” contribution for retirement plan and SIMPLE IRA participants who are ages 60-63. Here are answers to your top 12 questions: 1. When does the super catch-up...

Mar 23, 2025 | Uncategorized

-Darren Leavitt, CFA The S&P 500 avoided a fifth straight week of losses as investors continued to assess the impact of Trump’s policies. A late rally on Friday afternoon, fueled on heavy volume from quarterly options’ expiration, helped propel the S&P...

Mar 20, 2025 | Weekly Newsletter

Discover steps to help you prepare for retirement Imagine this: After decades of hard work and dedication, you’re just 12 months away from the retirement of your dreams. Exciting, right? But hold on, this final stretch is crucial. Let’s make sure you’re fully prepared...

Mar 20, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: I cannot find the indexed number for IRA bankruptcy protection for 2025-2028. It is $1,512,350 currently, but it is scheduled to increase on April 1, 2025. Do you know what it will be? Mike ANSWER: The updated IRA...

Mar 17, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Here is an all-too-common situation that seems counterintuitive: A participant in a 401(k) retires and must take his required minimum distribution (RMD). This person requests that his entire 401(k) plan balance be directly...

Mar 16, 2025 | Uncategorized

-Darren Leavitt, CFA Investors endured the fourth consecutive week of losses in US equity markets as concerns around tariffs and their impact on the economy continued to weigh on sentiment. Several investment banks decreased their assessment of US equities and...

Mar 14, 2025 | Weekly Newsletter

“Old age is always fifteen years older than I am.” —Bernard Baruch, American financier, investor, statesman and philanthropist One of the biggest fears people have is running out of money in retirement. And for many Americans, this is a very real risk, not an...

Mar 13, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: Hi, In a recent blog post, you addressed the complicated rules for a 401(k) to Roth IRA rollover. I have a similar question as it relates to a pre-tax IRA conversion to a Roth IRA. My client is a 95 year-old woman who has a...

Mar 12, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Everyone knows that April 15, 2025, is the deadline for filing 2024 income tax returns. But April 15 is also a crucial deadline if you made too many 401(k) deferrals in 2024. If you don’t fix the error by that date, the tax consequences...

Mar 10, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Do you have a Roth IRA? If you do, there will very likely come a time when you want to take a distribution from that account. The distribution rules for taxation of Roth IRA distributions can be complicated,...

Mar 9, 2025 | Uncategorized

-Darren Leavitt, CFA Economic growth concerns weighed on US financial markets as manic trade policy fostered uncertainty and volatility. It was a hectic week as investors tried to make sense of Trump’s tariffs on Canada, Mexico, and China. The announcement that...

Mar 6, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Question: Hello, If a person is turning 73 years old in March, s/he would be required to take required minimum distributions for the year. Can a person do Roth Conversion prior to turning age 73 (say in February)? Does the...

Mar 6, 2025 | Weekly Newsletter

As you approach retirement, you may be wondering what are the next steps for your investments. An annuity may be an effective tool for you in retirement planning by providing a steady and reliable income stream. With 2024 being the year with the greatest number of...

Feb 24, 2025 | Weekly Newsletter

Important Tasks & Decisions for Each Phase of Retirement Planning Retirement. It tends to be a catch-all word that generally refers to the light at the end of the tunnel after years of hard work. It’s a time to enjoy the things in life that matter the most, like...

Feb 23, 2025 | Uncategorized

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 hit all-time highs, but late in the week, the move abruptly succumbed to consolidation pressure. Investors are worried about valuations, trade tensions, inflation, and declining consumer sentiment. A...

Feb 20, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: Dear Ed Slott and America’s IRA Experts, I have a rollover traditional IRA that was set up when I left my last job. I am no longer employed, so I don’t have any earned income. My husband works full time, and our filing...

Feb 19, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst One important provision of the 2022 SECURE 2.0 law is the requirement that most new 401(k) and 403(b) plans must institute automatic enrollment. This rule is effective for plan years beginning after December 31, 2024. A “plan year”...

Feb 17, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Tax season is upon us! This is the time of year when many people consider making a contribution to an IRA. If you are thinking about doing so, here are 10 things you need to know. You can still make an IRA...

Feb 16, 2025 | Uncategorized

-Darren Leavitt, CFA Despite all of the uncertainties within the investment landscape, global markets were able to post nice gains last week. Fourth-quarter earnings continued to roll in with notable results from Coca-Cola, McDonald’s, Roku, Cisco Systems,...

Feb 13, 2025 | Weekly Newsletter

Inflation, uncertain markets and a limited Social Security COLA are among the financial hurdles for retirees in 2025. Key Takeaways High interest rates may complicate investment decisions for retirees. Social Security recipients are getting a 2.5% raise, which may lag...

Feb 13, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: I just inherited an IRA from my sister. She died at age 74 and I am age 78. Am I required to use the 10-year rule, or can I stretch distributions from the inherited account over my life expectancy? I am...

Feb 12, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst On January 21, Ichiro Suzuki was elected to Major League Baseball’s Hall of Fame by the Baseball Writers Association of America. It takes 75% of the writer’s support to gain entry, and Ichiro was chosen on 393 out of 394 ballots....

Feb 11, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Here’s one question that keeps coming up: If I retire in the year when I turn 73 (or older) and want to directly roll over my 401(k) funds to an IRA, do I have to first take a required minimum distribution (RMD) from my 401(k)?...

Feb 9, 2025 | Uncategorized

-Darren Leavitt, CFA Uncertainty about global trade continued to be at the top of investors’ minds as Trump announced 25% tariffs on Mexico and Canada while levying 10% on Chinese goods. Mexico and Canada’s immediate reaction was to place tariffs on US...

Feb 6, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Am I correct that a non-spouse Roth IRA beneficiary does NOT have a yearly required minimum distribution (RMD) over the 10-year period? Ken ANSWER: Ken, You are correct. Non-spouse beneficiaries of Roth IRAs that are...

Feb 6, 2025 | Weekly Newsletter

Key Points A modest cost-of-living adjustment (COLA) will make benefit checks bigger. Note that higher earners will pay a bit more in Social Security taxes. Retirees still earning income may have some of their benefits temporarily withheld. The $22,924 Social Security...

Feb 5, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education The deadline for most retirement account owners to take their 2025 required minimum distribution (RMD) is December 31, 2025. However, there are good reasons why you should take your RMD now instead of...

Feb 3, 2025 | IRA Blog

By Andy Ives, CFP®, AIF® IRA Analyst Just over 10 years ago, in June 2014, the U.S. Supreme Court ruled unanimously, 9-0, that inherited IRAs are NOT protected in bankruptcy under federal law. The primary issue before the Court was whether an inherited IRA is a...

Feb 1, 2025 | Uncategorized

Darren Leavitt, CFA US financial markets were extremely busy last week as a rush to download a Chinese AI platform called Deep Seek from Apple’s App Store seemingly changed the narrative around artificial intelligence in a heartbeat and on multiple fronts. Capital...

Jan 30, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst Question: I have an IRA holding an immediate annuity as well as other IRAs. With the passage of the SECURE 2.0 Act, l understand that I may be able to apply my monthly annuity payments against my RMD requirement for all of my IRAs....

Jan 30, 2025 | Weekly Newsletter

Key Points If you’re nearing retirement, key changes for 2025 could affect your finances, according to advisors. Starting in 2025, there’s a higher 401(k) plan catch-up contribution for workers ages 60 to 63. Plus, there are new rules for inherited individual...

Jan 29, 2025 | IRA Blog

By Ian Berger, JD IRA Analyst You probably know there’s a limit on the amount of pre-tax and Roth contributions you can make to your company savings plan each year. The 2025 elective deferral limit is $23,500 for 401(k), 403(b) and 457(b) plans and is either...

Jan 27, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Many of the provisions of the Tax Cuts and Jobs Act are scheduled to expire at the end of 2025. There are currently a number of proposals in the works in Congress to extend these tax cuts. A serious hurdle is how...

Jan 26, 2025 | Uncategorized

Darren Leavitt, CFA Wow, what a week! US markets were closed on Monday for Martin Luther King Jr. Day, and Donald Trump was inaugurated as the 47th President of the United States. It was a historic day indeed. The global markets were poised for a barrage of executive...

Jan 24, 2025 | Weekly Newsletter

Our checklist for retiring next year includes everything you need to do before the retirement party. Only you can know if you’re ready for a checklist for retiring in 2025. If you’re 60 or getting there, retirement is no longer a hazy concept in the distance....

Jan 23, 2025 | IRA Blog

By Sarah Brenner, JD Director of Retirement Education Question: I have a large non-qualified 457 deferred compensation plan and I am required to take distributions. I am looking to minimize taxes. Can I roll over these funds to an IRA? Answer: Unfortunately,...